In order to be compliant with European and Cypriot VAT regulations, we are required to remit a VAT tax on certain TrafficStars bidding transactions:

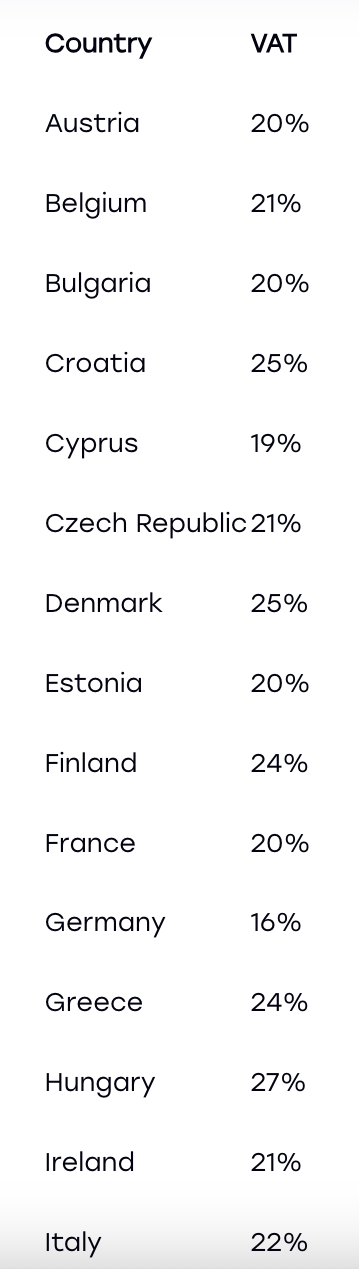

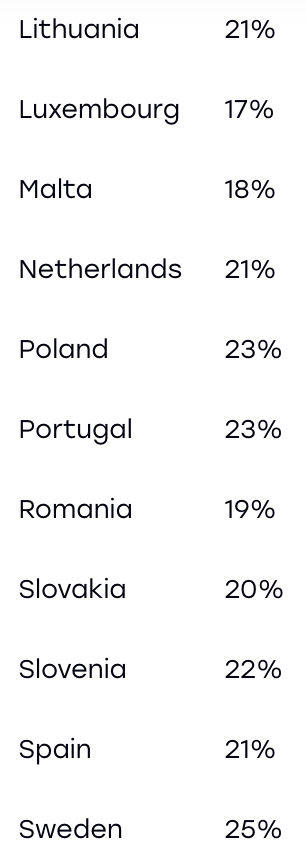

- Local VAT rate of country of residence is applied to individuals from EU countries

- Local VAT rate of country of residence is applied to companies from EU countries that cannot provide a valid VAT number

- 19% VAT rate is applied to both Cypriot individuals and Cypriot companies registered as well as not registered for VAT

- 0% reversed charge VAT is applied to companies from EU countries which provide a valid VAT number

- 0% VAT is applied to individuals and companies located outside the EU

- 0% VAT is applied to companies located in the exempt EU territories

Local Rates:

Please note that VAT is applied on top of the advertiser budget. If there are any issues with the invoice, please note that you have 7 business days to point them out to your Account Manager or our Support Team. This period starts on the date indicated on your invoice. After this time, we will not be able to review any invoice related queries. Thank you for your understanding.

support@trafficstars.com